Overview of a loan Profile.

Here, you'll find everything related to a specific loan profile.

1. To navigate to a Loan Profile;

Click on 'All Loans' in the dropdown menu of 'Loans' as shown below.

Find the specific loan from the Loan Listing Table as shown below and click on either the 'customers name' or the 'Go>>' button to navigate to the specific loan profile.

2. The Loan Profile.

I. General Details.

You'll find general details about the loan profile.

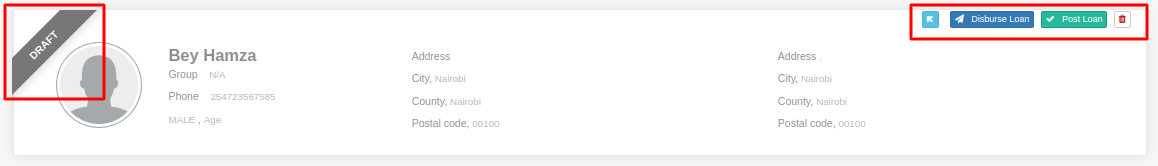

a.) Loan Application Status.

The "ribbon" shows the application status of the loan and the "buttons" show what actions can be performed for the different stages of the loan application.

They include;

Draft -> This shows that this is a new loan where no actions have occured. It is simply a draft. ie. Appraisal or Disbursement have not been initiated.

Actions

Actions available in this status depend on whether Appraisal is on or off.

Appraisal on.

You can initiate Appraisal

Appraisal off.

You can initiate Disbursement and Post the Loan.

In Appraisal -> This shows that Appraisal was initiated for the particular Loan and it is waiting to be posted.

Actions

You can resubmit the loan for approval and 'Approve' or 'Decline' based on whether you are an approver.

Denied -> This shows that the Approval was denied for the particular loan.

Actions

You can only delete the loan.

Approved -> This shows that the Appraisal was approved for the particular loan and it is waiting for the disbursement process to be initialized.

Actions

You can Disburse and you can Post the loan.

Disbursing -> This shows that the disbursement process has been initiated.

Actions

You can post the loan.

Failed -> This shows that the disbursement process failed.

Action

You can only delete the loan.

Completed -> This shows that the disbursement process was successfully completed.

Actions

You can generate a statement and you can delete the loan.

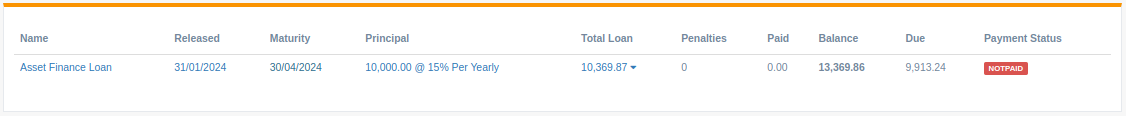

b.) Loan Summary Table

The loan summary table presents basic data pertaining to the loan profile.

c.) Loan Details Tabs

The "Loan Schedules" tab displays scheduled installment payments, which encompass the scheduled date, principal amount, applicable fees, and interest. Additionally, it offers the option to toggle between the scheduled and accrued schedules.

The "Charged Penalties" tab displays the total amount of penalties charged for the entire loan and provides detailed information about penalties associated with specific installments. Additionally, it offers the functionality to reverse penalties either from specific installments or the total penalties at once.

The "Loan Fees" tab displays information regarding fees charged for the loan and offers a functionality for users to add a fee to the loan.

The "Penalties Settings" tab enables users to select the penalties computation method between the current installment balance and the total loan balance. Additionally, it offers information regarding penalties for a loan and provides options to suspend or activate the penalty, along with a link to the system's penalty settings.

The Accrual Plan toggles between both the standard and custom accruals and has the functionality to adjust the interest calculation method buy clicking the 'Flat Rate' button.

The "Journals" tab shows the list of journals for the specific loan and the 'New Loan Journal' allows one to add a new journal to the loan,

Related Articles

Loan Listing Overview

Loan Listing is the page where you can see all loan data in your organization. Navigation Description 1. Search You can search for any loan using the searchbar. By default it searches using everything (loan number, customer name, customer phone, ID ...Understand Loan Fees Actions

This here is the loan profile module and part of the tabs is Loan Fees. Under loan fees a user will find fees attached to the loan. That is all the fees that are charged on that current loan. Among the actions for the loan fees is adding a a fee for ...How to disburse a loan.

1. Select a loan on the loan listing that is a draft loan. That is the loan that can be disbursed. 2. Once the loan in draft, you can vie the loan profile. You will see a disburse button on the right top corner. Click o n the button. 3. You will get ...Understand Loan payment actions

On the loan profile page there are various actions associated with payment. They will cut across the multiple stages of a loan cycle. Here is a view of the payment actions. a. Normal Payments b. Early Settlement 1. How to do a Paybill Payments: i) ...Understand Loan Penalty Actions

Penalty Actions are actions based on the current. The penalty actions vary from creating a penalty to changing settings on the penalty, to even reversing the penalty. 1. How to add a penalty charge? i) Under the loan schedule(This where you find the ...