How to activate Top -up loans

TOP UP LOANS is a feature that allows customers to take another loan even when they have an existing

one. To activate, as shown below.

This feature is particularly useful for your good customers when they’ve an emergency during the loan period. Below are steps to activate this feature:

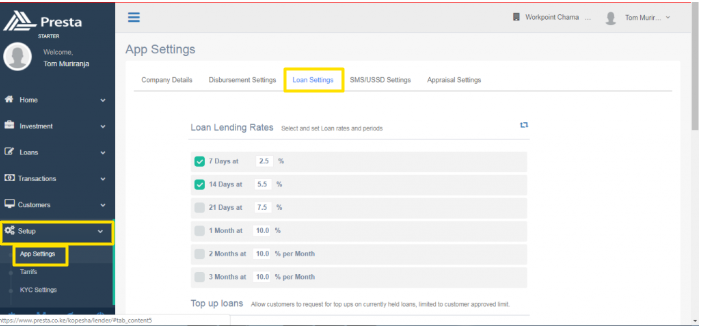

- Go to Set up on the left Menu drop down

- Click on Setup

- Select app settings

- Click on Loan Settings Tab.

- Scroll down past Lending Rate settings, you’ll see top-up loan settings.

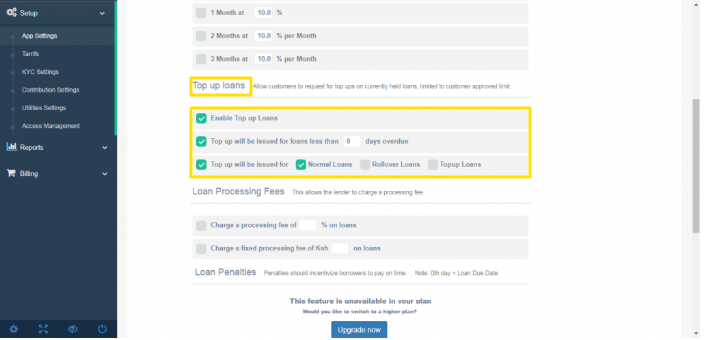

- Check the checkbox written Enable-Top-up Loans (as shown on the screenshot below)

- There are a few ground rules you might want to consider. To allow customers add on to a loan, there are a few options on the check boxes.Top up loans issued for loans less than a specific number of overdue days. If for example you set 0 overdue days, then a customer who is due by a day or more does not qualify for a top up loan.

- Top up loans will be issued for

- i. Normal loans

- ii. Rollover loans

- iii. Top up loans

- Normal loans – A customer who has a loan already can take up another, within their loan limit and within the limit of the days overdue. According to your settings on the overdue days.

- Rollover loans– Ticking on this box means that for any rollover loan , the customer is still then able to access a top up loan, as long as it lies in their loan limit balance.

- Topup Loans– If a customer has a normal loan already, and before clearing it he takes another (in this case a top up loan) but still has a remaining amount from their limit, then the customer can take another loan. on top of a top up loan.

Related Articles

Requirement to acquire your own paybill

As a lender you need to have two paybills: One for disbursing Loans (B2C Paybill) and another for Receiving Loans (C2B Paybill). Application for this paybills is FREE and Presta doesn’t charge anything for linking this Paybills to your account. ...

How to set up penalties

To activate and enable penalties on your account Go to setup on the menu App settings Click on loan settings Scroll down to Loan Penalties There are two types of penalties. One time and Recurring. For each type, you have the option of either setting ...

How to set loan rates

To set up the loan rates, Go to setup on the menu Click App settings on the drop down On the options provided, select Loan settings There are different types of loan terms on the platform, The Lender can activate all, or a few by checking the check ...

How to recover missing transactions

Sometimes a customer makes a payment and it is not reflecting on their account, or generally on the system: To recover this, Obtain the Mpesa transaction from the customer or Mpesa Go to transactions, on the menu Select C2B in the drop-down Click on ...

What is Presta?

Presta is an easy to use USSD enabled lending and collection platform for credit organisations including: Microfinance Institutions Credit-Only Organisations. Chamas Individual Lenders Saccos What Presta offers is a secure and reliable Loans Service ...